Get the free first b notice form template word

Show details

Information on SSA×39’s records is different from that on your social security card, and to resolve any problem. Also, put your name and SSN on the enclosed Form ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your first b notice form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first b notice form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing first b notice form template word online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit b notice template form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

How to fill out first b notice form

How to fill out b notice template:

01

Begin by inputting the recipient's name and contact information.

02

Clearly state the purpose of the notice and the reason for issuing it.

03

Include specific details regarding the discrepancies found in the recipient's tax information.

04

Provide instructions on how the recipient can correct the errors or discrepancies.

05

Include a deadline for the recipient to respond or take action.

06

Sign and date the notice before sending it to the recipient.

Who needs b notice template:

01

Employers who have discovered discrepancies or errors in their employees' tax information.

02

Financial institutions or lenders who are required to report information to the IRS.

03

Any party responsible for issuing1099 forms or reporting income to the IRS.

Fill sample b notice irs : Try Risk Free

People Also Ask about first b notice form template word

What does AB notice mean?

Why did I receive AB notice?

What is a B notice form?

What is required on IRS B notice?

What is the B notice to the taxpayer payee?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

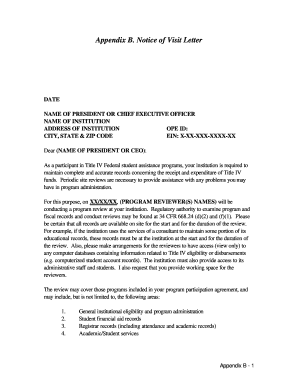

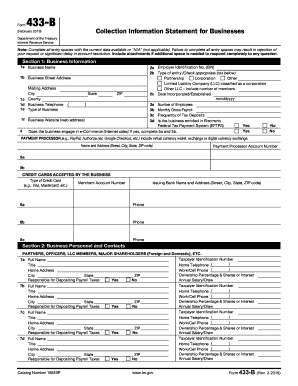

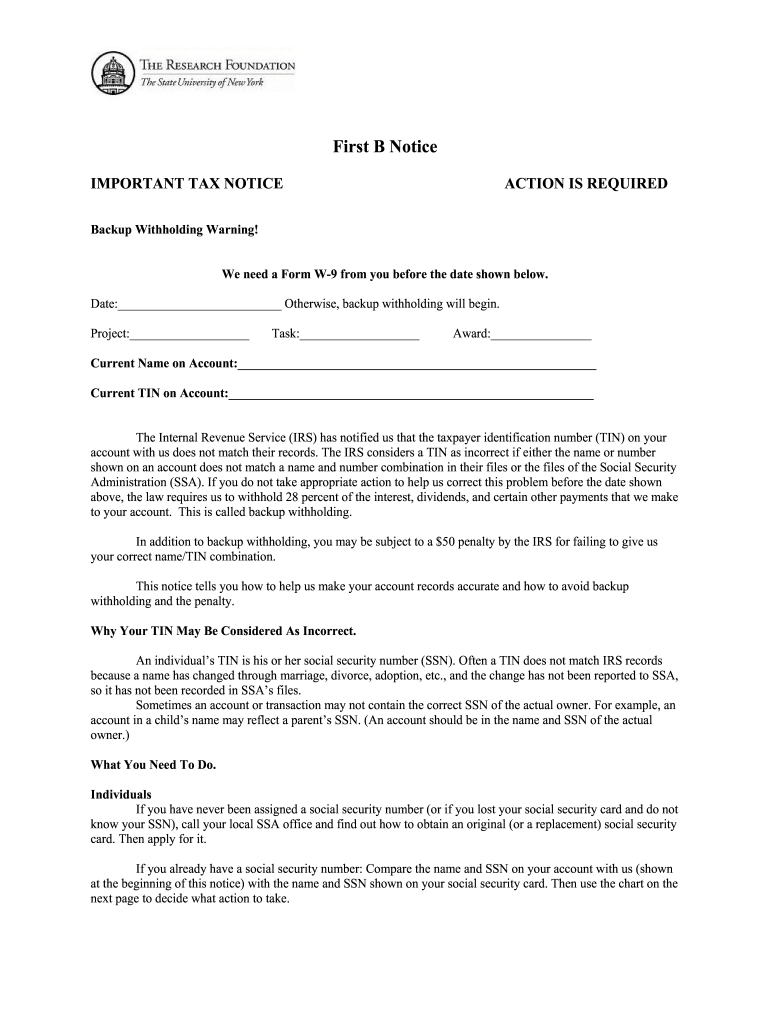

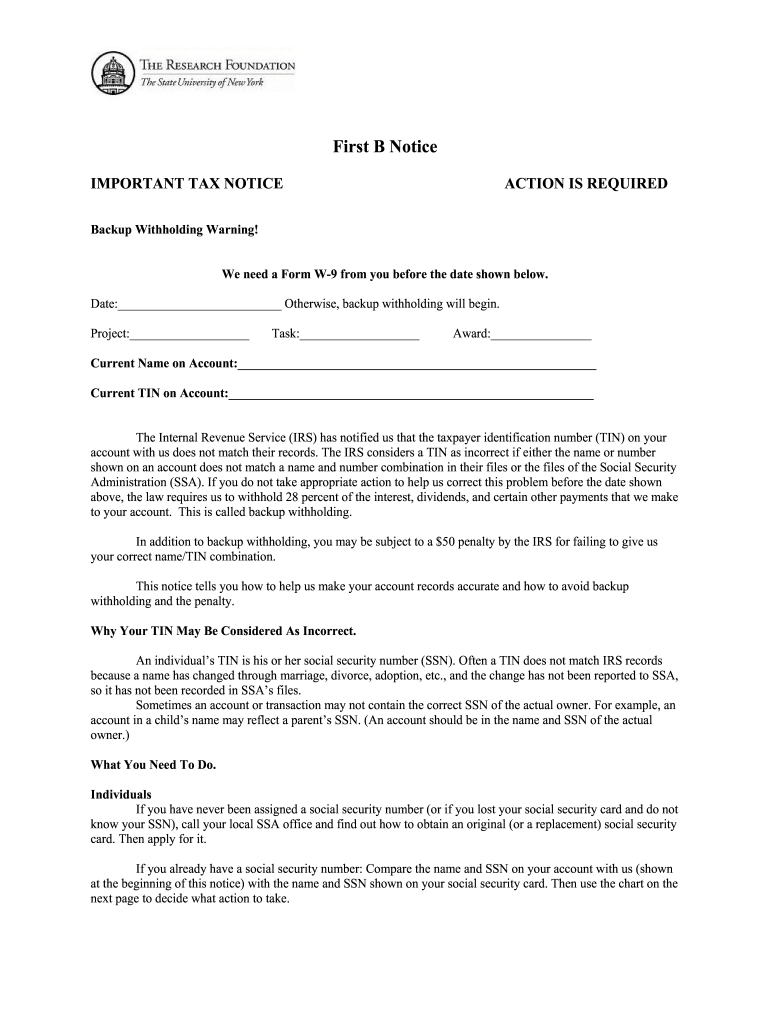

What is b notice template?

A B Notice template is a written notice sent to an employer by the IRS. The notice requests that the employer provide information on any employees who have failed to provide their taxpayer identification number (TIN) when filing their tax returns. This information helps the IRS ensure that the employee is paying the correct amount of taxes. The template typically includes the employee's name, address, Social Security number, and other relevant information, and may include a deadline for response.

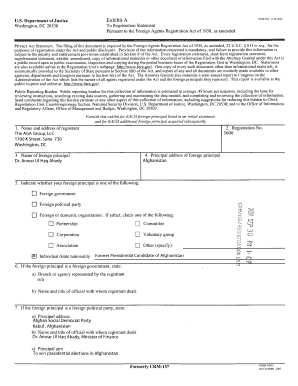

Who is required to file b notice template?

The B Notice is used by Internal Revenue Service (IRS) to request that a payer verify certain information on an individual's Form W-9. The B Notice is sent to the payer, who is then required to provide the IRS with the taxpayer's correct name and taxpayer identification number. The payer is required to complete and return the B Notice to the IRS within 30 days.

How to fill out b notice template?

A B Notice is a notification letter sent by the IRS to employers when they have failed to report an employee’s name and/or Social Security Number (SSN) correctly on a Form W-2.

1. Start by gathering the necessary information to complete the notice. This includes the employer’s name and address, the employee’s name and SSN, and the Form W-2 information.

2. Download the B Notice template from the IRS website and fill out the necessary information.

3. Check that all the information provided is accurate and complete.

4. Carefully review the notice to make sure there are no errors.

5. Sign and date the notice and keep a copy for your records.

6. Mail the notice to the employee and the IRS within 30 days.

What is the purpose of b notice template?

A B Notice template is used to remind taxpayers that they may have failed to provide their taxpayer identification number (TIN) to the payer of the income. It includes a warning that failure to provide the TIN may result in the backup withholding of income.

What information must be reported on b notice template?

The information that must be reported on a B Notice template includes the taxpayer's name, address, and taxpayer identification number, the amount of the reportable payment, the payer's name and address, and the date of the payment.

What is the penalty for the late filing of b notice template?

The penalty for the late filing of a B Notice Template varies depending on the jurisdiction and the specific circumstances. In the United States, the IRS imposes a penalty of $50 per form for late filing of the B Notice Template. The penalty can increase to $270 per form if the B Notice Template is not filed within 30 days of the due date or if the B Notice Template is not filed correctly. It is important to consult the specific tax regulations in your jurisdiction to determine the exact penalties for late filing.

How can I send first b notice form template word to be eSigned by others?

Once your b notice template form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I edit b notice letter template on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share irs b notice word template from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out first b notice template on an Android device?

Use the pdfFiller app for Android to finish your irs b notice pdf form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your first b notice form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

B Notice Letter Template is not the form you're looking for?Search for another form here.

Keywords relevant to irs b notice template form

Related to sample b notice

If you believe that this page should be taken down, please follow our DMCA take down process

here

.